The stormy summer period for supporters of green energy in the UK continued recently with the Department of Energy and Climate Change (DECC) issuing yet another consultation document on 27 August 2015 – this time proposing new cost control measures under the Feed-in Tariff (FIT) scheme. The document cites a need to “put the scheme on an affordable and sustainable footing” amidst higher than expected renewable energy deployment and significantly reduced technology costs.

The measures proposed include revised tariffs, a more stringent degression mechanism, and deployment caps leading to the phased closure of the scheme in 2018-19. They are intended to limit the financial burden on consumers who ultimately pay for renewable energy subsidies through their electricity bills, and the review follows an earlier consultation spanning July and August 2015 outlining proposals to remove ‘preliminary accreditation’ for FITs, protecting bill payers against deployment surges. It has subsequently been announced that preliminary accreditation will be removed from 1 October 2015.

The new generation tariffs are based on fresh evidence about costs and rates of return, with DECC proposing a new cap on FITs expenditure of between &75m–&100m from January 2016 to the point of closure. The document suggests that if these cost control measures are not implemented then the only alternative would be to end generation tariffs for new applicants as soon as January 2016.

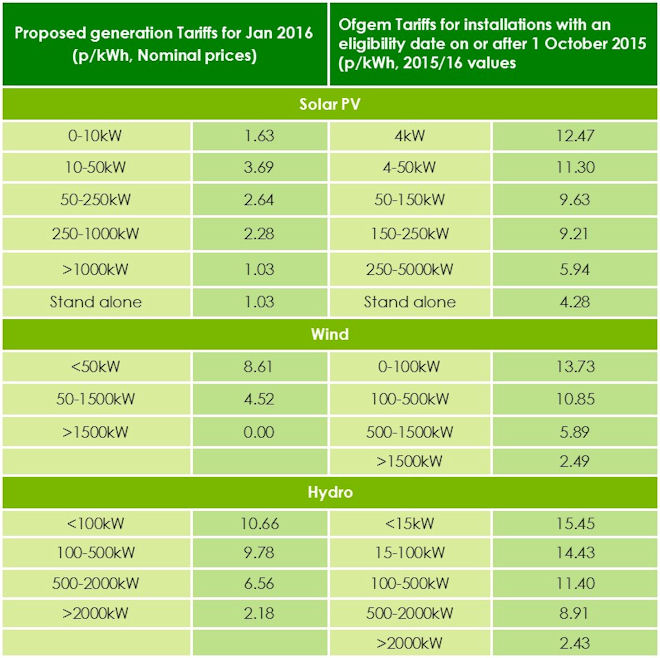

The proposed bandings and rates are as follows:

Solar

Domestic solar PV will be hardest hit with a massive 87% reduction, whilst the other tariff bands for solar are proposed to go down by approximately 75%. If implemented these reductions will make a lot of solar projects financially unviable unless panel prices fall considerably, which is not expected to happen in the next 2-3 years.

Wind

The tariffs for the most popular wind turbines (50kW-500kW) are proposed to reduce the by 25-40% meaning, unless situated in very high wind speed areas, they are unlikely to be viable. The Government’s recent announcements for onshore wind have made obtaining planning permission almost impossible, so these latest proposed changes could be the final nail in the coffin.

Hydro

Hydro projects look set to be hit less hard with average reductions typically between 25-30%.

AD

Anaerobic Digestion (AD) plants are not proposed to be subject to tariff reductions but the Government are considering implementing “sustainability” criteria for feedstocks for new AD installations under the FIT scheme.

DECC has also proposed that full degression for all technologies should be quarterly. If the changes go ahead contingent degression will now be 0%, 5%, or 10% for all technologies depending on deployment rate and this will be in addition to default degression.

DECC have not proposed any change to the export tariffs in this review. However, they are consulting on options to ensure that the long term sustainability of the export tariff. The reason for this is that wholesale electricity prices have dropped and they want the future export prices to reflect the actual electricity market value.

Darren Edwards, a Partner in Fisher German comments “the implications of this latest consultation compound the uncertainty and instability already present in the renewable energy marketplace. If implemented, the proposed cost control measures threaten to trigger an immediate ‘lights out’ for a UK industry that has been buoyant through the recessionary period. A large proportion of our client base, some of whom have invested heavily in the FIT market over the last 5 years, will lose out should the Government make the cuts and some businesses will undoubtedly go under. Emerging technology, such as commercial scale lithium-ion batteries, offer some future hope for the renewables sector but again this is a few years away so such drastic Government cuts in the short term seem premature”.

Click here for more information about our renewable energy sector