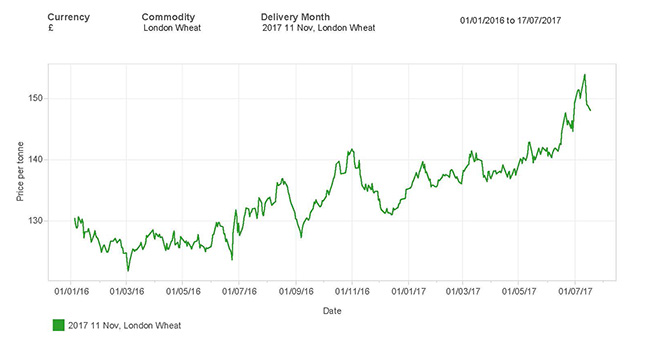

As the direct subsidy (pillar1) support for farmers decreases and the post Brexit world gives increasing exchange rate fluctuations and political volatility, the financial & regulatory risk for farmers increases. Markets are becoming increasingly complex and financial volatility will continue. The increase in wheat price since the GBP has fallen against the Euro for example will alone equate to the Basic Payment Scheme payment on a &/ha basis.

Guessing the direction of market is risky in this volatile environment and the impact of getting the timing wrong higher, as the spread between the highs and lows over the last two seasons has shown.

Managing input and output price risk is therefore increasingly important to ensure farm profitability and the starting point is knowing your cost of production. Farmer’s cost of production figures should enable agricultural businesses to;

1) Understand where the cost lies in their business and therefore, what are the priorities to tackle

2) Benchmark the business against others and see where improvements can be made

3) Know at what price they can lock into a profit when selling their produce or purchasing inputs.

The second part of managing risk is using the tools available to reduce it to an acceptable level such as;

a) Interest rate risk - Balancing fixed and variable borrowing rates on loans

b) Sale price risk - Selling on fixed price contracts, pools or using options

c) Input price risk - Buying through groups, planning forward purchases etc

d) Exchange rate risk - Hedging subsidy payments against the euro in the short term, forward purchasing imported inputs etc

Risk will never go away but a systematic approach to managing it can avoid putting businesses into situations which compromise their financial viability and sustainability. The need to do this continues to increase and is likely to do so further as the post Brexit world becomes clearer.

Our Farms department would be pleased advise you how to manage risk in your own agricultural business, Contact David Kinnersley on 07501 720405 or email here